September 26, 2022

Pricing strategies for consumer products

The best-selling textbook on price management (Simon/Fassnacht) completely missed the topic of consumer goods pricing until the second edition. It is no coincidence that the industry struggles with a number of peculiarities that particularly concerns the cooperation with retailers.

– It is the retail that sets the prices, not the consumer goods industry: it is not directly useful to know the optimum price. It is necessary to convince the retailer of this.

– The consumer goods industry may have a different optimal price point: depending on the price pressure and the retail margin that the retailer adds, the optimal price may be different. A lower price definition may often make more sense for the retailer than for the manufacturer.

– The retailer competes with the other purchasing sites and chains and thus optimizes the overall offer, not just the individual product. This is another reason why retailers may act against the interests of the brand companies and

– decides independently on price promotions and thus often increases price sensitivity. In the focus standing products as for example beer unfortunately so often under promotion-induced price sensitivity. Many consumers have learned to buy only at promotional prices.

Other special features influence the pricing of consumer goods companies:

– Shopper marketing (shelf management and placement) influences the subjective degree of distribution and the willingness to pay. A shelf near the checkout is known to have the greatest distribution power. Placing a product in a high-priced shelf environment promotes price acceptance.

– High number of new products each year and high number of packaging changes each year leads to a continuous need for pricing insights.

– No immediate, naturally occurring contact with the customer: Other industries usually have a good qualitative stream of customer feedback through physical contact with customers. This is usually not the case for consumer goods manufacturers. Special efforts are needed to compensate for this.

– High market dynamics, prices and competitors change quickly depending on the market: one’s own pricing must keep pace here without becoming erratic.

In this article, we would like to show how it is possible to master the challenges described. We will also show examples of what a modern approach can achieve:

The bestselling book „Pricing Intelligence“ has more on the topic and

A well-known soft drink brand in Austria wanted to introduce a new vegan drink.

As part of the product management process, the brand had already defined the price relations and hierarchies in the product portfolio. The product was categorized as a special edition. This means that it will always have to be priced above the standard product.

To determine the optimal price, an implicit intelligence method would be used. For this it is necessary to define the following information in advance:

– Product name and packaging design

– Product short description as the consumer and the final consumer will perceive it.

– Price range i.e. the expected price as well as the under and over price limit. The expected resulted from the price hierarchy.

– Definition of the target group by demographics and screener questions.

The results were surprising. The existing strong brand not only led to a high willingness to pay, but also has always favored a moderate dealer margin by comparison. The result showed an optimal price point 20% higher than expected.

The challenge now was to enforce this unexpected price as the shelf price in negotiations with retailers. It helped to incorporate the evidence of the willingness-to-pay measurement in the retailer discussions.

The launch was a success. The positive reaction of the customers helped the retailers to maintain the price level.

The successful establishment of this unexpectedly high price suggested that other products in the range also had potential for optimization. Thus, the central existing products including different container sizes were also subjected to a test.

A heterogeneous picture emerged. Some products were overpriced and others underpriced. Again, the retailer’s optimal shelf price was close to the manufacturer’s optimal shelf price. This allowed the brand to incorporate its own market research findings into the price negotiations. A partial price adjustment upwards and downwards was achieved.

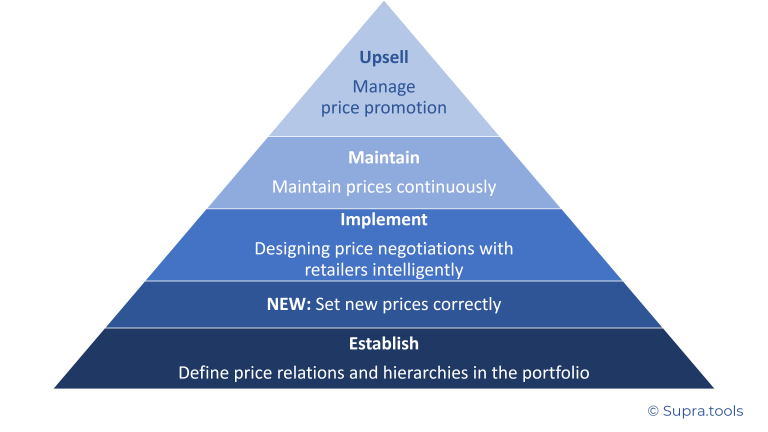

The example is an illustrative implementation of the ENIMU concept:

Successful pricing of consumer goods requires professionalization in all 5 steps. This is how it works in detail:

Establish – define price relations and hierarchies in the product portfolio.

The perceived value of a product depends to some extent on the pricing of related products. The prices you can control as a brand are those of your own product portfolio.

These prices should inherently make sense. Documenting a value and pricing hierarchy is a common practice for consumer product companies. But too often, relationships are hardwired by fixed percentages, and these values are more the result of a qualitative process – rather than an evidence-based process.

So instead of basing the hierarchy on gut feeling and rules of thumb, the overriding measure should be evidence regarding willingness to pay.

In concrete terms, this means that first and foremost, price responses should be measured for each product and these results calibrated using the hierarchy, if necessary. If a new product is to be introduced and the pricing determined for it does not fit into the pricing system, then it should be considered whether the price willingness of the other products should not be evaluated again.

All this is mostly omitted today, because the suitable Insights technology of the Implicit Intelligence™ is still hardly known. It enables precise, cost-effective evaluation of price readiness.

NEW – Setting new prices correctly

The pricing of new products is of strategic importance for several reasons.

When introducing new products, there is no established reference price in the negotiation with the retailer as well as from the customer’s point of view or the reference can be controlled by communication. During this time, the reference of the established product is the current price. The change of this requires a particularly stronger justification and negotiation tactics.

Therefore, it is an absolute must to calculate the exact willingness to buy depending on the price. The optimal pricing results from the price point at which the surplus for your brand is maximized. A precise and cost-effective optimization is enabled by Implicit Intelligence™ for Pricing solutions such as supra.tools

Implement – Intelligently design price negotiations with retailers

The moment of truth takes place in the price negotiation with retailers. Here, good preparation is worth its weight in gold.

Step one is to determine the optimal final price. After determining the price-sales function somewhat with Implicit Intelligence™ for Pricing, the profit-maximizing price is as follows:

– Calculate the revenue in which the projected sales are multiplied by the price.

– Subtract from the sales 1. the value added taxes (in the USA), 2. the cost of goods sold (COGS), 3. the retail margin

– Topic Retail Margin: As a rule, retailers act according to established rules, which usually provide for the markup of a certain percentage. This expected percentage is approximately known from the past for each retailer.

Now and then other qualitative considerations and beliefs of the traders intervene, which then have to be cleared up in the conversation.

Again, researched evidence is most useful for this conversations. The optimal final price can be found by assuming the Retailers margin, the available data can be used to determine the final price that is optimal for the retailers profit.

This is often similar to the company’s own optimal price. If brands now share their own insights with the retailer, this is a heavyweight argument in the negotiation situation.

Some professionals prefer to access video tutorials around pricing and insights

In some cases, however, the optimal prices for consumer goods manufacturers and retailers diverge strongly. If the margin of the retailer is by far greater than that of the consumer goods manufacturer, the result is an imbalance that cannot be compensated for by sharing insights.

So for the case, where the retailer tends to go far below the recommended retail price AND AT THE SAME TIME, this is also according to evidence the most profitable point for the handlerretailer….

…for this case an optimization on the second level should take place: by a higher selling price, the calculation of the handler retailer can be influenced and a higher final price can be reached. The exact optimum results are available from the insights and a simple simulation calculation. Tools for this are available on the market (e.g. supra.tools).

Maintain – continuously maintain prices

Consumer goods companies are reluctant to address the issue of changing the sales price. Retailers also perceive such discussions as pure cost-increase talks. This is because, for them, market prices are set and established and only change as a result of external influences, such as the introduction of a new product innovation or an inflation-driven wave of price increases.

However, if both sides have evidence of how demand reacts to pricing, discussions can be constructive and productive.

Practice shows that it is worthwhile to regularly put existing prices to the test. Most prices are not set optimally right from the start. If competing products are added over the years, or if brand or product preferences change, the willingness to pay also changes step by step.

It is logical that a re-evaluation of the prices is advisable – approximately every year. This becomes even clearer when the enormous profit lever of the price is taken into account. The investment in this evidence is amortized after a few days.

Upsell – managing price promotion

Price promotions are the classic way in a go-to-market strategy of retailers to attract customers and maintain the price image. In the consumer products industry, companies are usually asked to participate in the promotion by offering a reduced sales price.

The retailer’s argument is initially conclusive: A price promotion also convinces customers who would otherwise not buy. This increases the number of first-time buyers and thus significantly increases the chance that the number of repeat buyers will also rise. The brand also receives additional communication contacts, with “mental availability” and thus brand strength also increases.

The effects of these benefits of this type of pricing strategy can be measured well. Unfortunately, there are also disadvantages. These disadvantages are difficult to measure. Price promotions lead to early purchases at a lower price. New customers who enter at a bargain often do not have the willingness to buy at regular pricing.

Smart management of price promotions tries to balance both. To do this, it is necessary to quantify two effects:

– What proportion of additional buyers would have purchased the product at a later date? This can be determined by price-marketing mix modeling

– Which discount level can be expected to have which sales effects?

The latter is often determined from past data. However, these usually only provide very specific discount levels “50% off” and types “Buy-One-Get-On-Free”.

Here, too, the use of price-readiness measurement methods such as Implicit Intelligence makes sense. Often 40% or 33% off results in almost the same effect as 50% off. You would never find this out if you either tried it once or just measured it.

Especially with new products there is no empirical knowledge about the reaction to discounts. Here, there is no way around the mentioned methodologies for willingness to pay measurement. It is worthwhile to use them. Because without a quantitative assessment, you are flying blind.

The pricing of consumer goods has a special complexity. Retailers set prices, not manufacturers. Retailers may have a different optimal price point. In addition, the retailer competes with other shoppers and therefore has a different calculation. Shopper marketing also influences the willingness to pay. Retailers also decide independently on price promotions. The high number of new products increases the complexity and a high market dynamic makes a constant optimization necessary.

Nevertheless, with the right methods, it is possible to set shelf prices approximately at the optimal price for the manufacturer, to have promotions take place to an appropriate extent and frequency, to maintain an overview at all times, and to do so at affordable costs – even for medium-sized businesses.

Levers for this are

– The management of price relations and hierarchies in the product portfolio

– Setting new prices correctly

– Intelligent price negotiations with retailers

– Continuously maintaining and renegotiating prices

– Managing price promotion intelligently

The key success factor is to generate the right insights regarding willingness to pay. In recent years, considerable success has been achieved in this area with the help of implicit intelligence methods for pricing. Supra.tools is the founder of this method class.

Today pioneers use the latest pricing survey tools that use Neuroscience + AI

Interested professionals can use some tools even for free and explore on its own

You can access supra tools free here.

Pricing your products is a big decision that will ultimately have a large effect on your business. A strong pricing strategy is a lot more than just calculating the costs and adding a markup.

So here are eight effective pricing strategies that will help you make your business more competitive, and make more sales.

Now, pricing your products always starts off with math. You absolutely need to know how much it costs to make a product or obtain a product and get it to market. This includes your production costs, business costs, marketing cost benefit analysis, and shipping and handling costs.

But though it always starts with simple math, a pricing strategy isn’t all arithmetic. The reality is that humans are creatures of emotion, and it’s incredibly rare that we make all our decisions exclusively through the lens of logic.

Here is a simple truth.

What a customer is willing to pay for the product isn’t really about how much the product costs?

What it’s actually about is how they perceive the product’s value.

So let’s get into some pricing strategies that just might change the way you

think about pricing your products.

According to customer focus, customer research, and profit margins, here are some best pricing strategies mentioned below:

Cost Plus Pricing

First, let’s discuss Cost Plus Pricing.

Cost Plus Pricing is by far the easiest way to think about pricing your products. I’m mentioning it here first, simply because it’s popular. Not because it’s the best pricing strategy.

Cost Plus Pricing is exactly what it sounds like calculating the costs of your products and adding on a markup. For retailers, this markup is often double the wholesale price, but the market percentage is variable depending on your business.

While this strategy does preserve a nice profit margin, there are some issues because it doesn’t take into account market factors like competition or demand for your product. So it can actually lead to a situation where you’re charging too much or too little.

Here are some different pricing strategies

Competitive Pricing

Next, we have Competitive Pricing.

Competitive Pricing is when you check out what your competitors are charging to figure out the going rate. Then rather than focusing on profit margin as a starting point, this pricing strategy is about making the price of your products comparative, and you can do this one of two ways.

The first is a lower priced offering than the competition thereby attracting potential customers and this will also attract price-sensitive customers.

Think Walmart versus whole foods. If you have lower costs and can actively promote your special pricing, then this can communicate that your brand is economic and accessible.

The second is pricing your products slightly higher, signaling that your product might be better and quality than your low-cost competitor.

Think Starbucks versus Dunkin Donuts. Competitive pricing is often used in highly saturated markets with highly similar products, where pricing can be a differentiator.

Skimming

Next, we have Price Skimming. Price Skimming is when a company charges the highest possible good price for a product, right from the outset, and then decreases it over time.

This is a pricing strategy that Apple has used for years. Price Skimming works best when there is a scarcity of a product and when new versions of that product will be rolled out in the future, justifying the reduced cost of the previous generation, because it’s become less relevant.

This pricing strategy is best used by successful companies that have stand-out products with features that other companies just can’t compete with.

So if your business has a prestigious image and creates innovative products, Price Skimming could be the pricing strategy for you.

However, it’s not going to work if you’re in a saturated market and your product doesn’t truly stand out.

Premium Pricing

A premium pricing strategy, also known as prestige pricing or luxury pricing, is when a company prices its products high to give the impression that they are high-value, luxury, or premium packages. The apparent value of a product, rather than its real value or production cost, is the subject of prestige pricing.

Premium pricing is highly dependent on how your product is perceived in the market. Using influencers, limiting supply, and driving up demand are just a few techniques to promote your product is designed to persuade a premium perception of it.

Penetration Pricing

Now let’s talk about Penetration Pricing, which is when you use a low price to enter a market. It’s used to draw attention to your business and take away business from competitors who effectively can’t match that price so that you can easily attract budget-conscious customers.

Once you have more wallet share, then you begin raising the price. This pricing strategy is famously used by internet service providers, like Comcast, who attract customers with cheap introductory prices. But once the introduction is over, the price of the service goes up.

In retail, this means intentionally pricing items low. For example, the grocery store Costco prices organic food items at lower prices than can be found elsewhere.

But while these prices are low now, we can expect, they will increase over time as they capture more of the organic food market.

Discount pricing like coupons, seasonal pricing, and of course sales, can all be forms of penetration pricing as well, helping stores get rid of old inventory and attract some short-term traffic to the store. The logic behind Penetration Pricing is that once the sale is over, some customers will remain loyal to the brand in the long term.

One important thing to be aware of is that too many sales can make people wary of paying the regular price and too low prices can create a perception of bad quality products.

Next, we have Value-Based Pricing.

Value-Based Pricing is when you set the price based on how much the customer perceives your product to be worth. This is done by locating data on what customers pay for comparable products, then listing what makes your product different and better. Then you need to place a financial value on those differentiating features.

Lastly, you need to communicate the extra value your product provides to customers.

Now, Value-Based Pricing is one of the most ideal strategies for entrepreneurs. However, it only works if you have a differentiated product and you are genuinely providing more value than your customers pay a price.

Value-Based Pricing, when done right, is a great way to build customer loyalty,

but it demands you stay in lockstep with your customer’s desires.

Loss Leader Pricing

Now let’s talk about Loss Leader Pricing.

Loss Leader Pricing is a strategy where you price a product for a Loss intentionally or offer a significant discount to attract customers’ focus, to get more customers, to get them in the door, or to your site where they may buy other items.

Now, while this might sound a lot like Penetration Pricing on the surface, it’s only tangentially related because the motive is entirely different.

The goal with loss leader pricing is to make the pricing work and give profit on the items, not by increasing the price of the item you’re taking a hit on. Loss Leader Pricing is heavily employed in the video game industry where game consoles are sometimes sold for less than the cost to build because the profit is made on video games and subscription services.

A Loss Leader strategy is best employed by larger companies who have other products they can sell to make up for the loss.

Bundle Pricing

Now let’s talk about Bundle Pricing.

As the name probably applies, Bundle Pricing is when you sell two or more complementary products together for a single price. Now, this doesn’t require much explanation, but it’s used by companies to add value for customers at a lower cost, hopefully, increasing the number of sales and increasing loyalty to the brands.

For example, getting a new phone with your data and phone plan is an example of Bundle Pricing

Anchor Pricing

Now let’s talk about Anchor Pricing or psychological pricing.

Anchor Pricing is the use of comparison, and everyone knows humans love to compare things. It is a consumer psychology fact. With Anchor Pricing a retailer lists both the discounted price and the original price right beside each other, to establish the savings you’ll gain from buying right now.

Anchor Pricing triggers what is known as the anchoring cognitive bias, where an initial piece of information is used as the anchor, by which all following judgments are made. If you’ve ever seen a price slashed out and a discount next to it and thought, I better take advantage of this while it lasts, well you have just participated in anchor pricing.

Psychological Pricing

Psychological pricing does exactly what it says on the tin: it uses human psychology to increase sales.

Customers may see a product that costs $99.99 as a good deal solely because of the “9” in the price, even though it is effectively $100, as per the “9-digit effect.”

To achieve the best outcomes, psychological pricing strategy necessitates a thorough grasp of your target market. If your clients are drawn to discounts and coupons, marketing that appeals to this need can help your item meets their psychological demand to save money. If your target market values quality, having the lowest price on the shelf may not help you meet your sales targets. Regardless of why your clients are willing to pay a fee,

Good better best pricing

The better, best pricing strategy, also known as tiered pricing or price brackets or g b b offerings, is when you give clients 3 distinct service packages alongside each other. It is the best way to overwhelm customers, rock bottom prices and revenue growth

Each package is slightly more expensive than the previous one, and each one includes extra services, multiple features, promos, or other sources of value. A Bronze, Silver, or Gold offer, for example, Basic, Advanced, or Deluxe.

Dynamic Pricing Strategy

Dynamic pricing is a pricing strategy that involves setting prices for products or services based on dynamic (changing) conditions. This strategy can be used in order to take advantage of market fluctuations or to simply respond to customer demand in real-time. In either case, dynamic pricing can help businesses optimize their pricing in order to maximize profits. There are a few different ways to implement dynamic pricing, but the most common is through the use of algorithms. These algorithms take into account various factors such as supply and demand, competitor prices, and customer demographics in order to set prices that will maximize revenue.

Very interesting:

Companies entering the field of pricing strategies through brand evaluation and price premium measurement can apply for a free strategy session at supra.tools as a service. If the prerequisites are right, this should usually be feasible at short notice. (Just send a short message to wolfgang@supra.tools)

In my email newsletter “Pricing Insights” I cover the whole range of pricing insights solutions-from Garbor Granger to Conjoint, from NeuroPricing to Pricing Software Systems. I describe the application in various fields from new product pricing to promotion, from brand premium to feature pricing.

Keep up to date here.