April 26, 2022

Classic survey methods for finding optimal prices - In focus: the Gabor-Granger Method

Most textbooks assume that companies know how their customers react to product prices and price changes. The object of desire is formally called the price-demand-function or price elasticity.

More strikingly, are these three facts:

As a rule, only selected new products are analyzed.

There is also sales modeling, where the price-sales curve for a given product in a given market can be calculated based on actual shelf prices and sales data to obtain a narrower price range. The methodology is only suitable for established products, considers only a narrow price range, and involves significant costs.

In short, there is a clear need to understand customers’ willingness to pay, especially for new products.

The bestselling book „Pricing Intelligence“ has more on the topic and

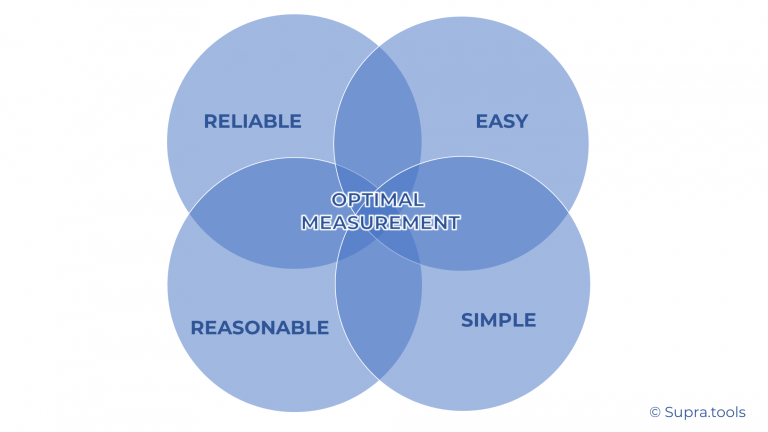

If one wants to use willingness-to-pay measures more broadly, four goals are crucial:

Ease of set-up

Ideally, companies can set up their own market research without having to go to a dedicated market research agency. Even medium-sized companies often have hundreds of SKUs, launch new many SKUs every yearand therefore need solutions for all products.

Cost-effective

Apart from the number of SKUs, the price per measurement should not be an insurmountable investment, as the investment required can increase quickly over hundreds of SKUs.

Ease of interpretation

Insights are most effectively implemented in an organization when they are easily accessible and understandable.

Reliable and accurate enough

The simplest, cheapest, and most accessible solutions are not worth implementing if they do not provide valid results. Biased information can even be harmful.

André Gabor and Clive Granger vary the monadic price test

The Gabor-Granger model was developed in the 1960s by Clive Granger and André Gabor. It is a variation of the monadic price test. Monadic testing means that respondents are divided into several groups and each group is presented with one of several concepts to determine what a target group’s opinion is of the concepts and what specific features and characteristics they prefer or dislike….

The Gabor-Granger method addresses the disadvantages of the van Westendorp method and asks for direct willingness to buy at specific price points. The key question at the beginning ensures that the respondent is interested in buying in principle:

Gabor Granger Method Question 1:

“How likely is it that they would buy this product at a price that is reasonable for you?”

The answer is measured on a 6-point scale from “1=very unlikely” to “6=very likely”. Respondents who score 4-6 would consider buying and are then asked specific questions about several concrete price points that have been firmly defined in advance. Due to the anchor price effect, one always starts with the highest price and lowers it step by step in the sequence of the questioning:

Gabor Granger Method Question 2:

“How likely is it that you would buy this product for $399?”

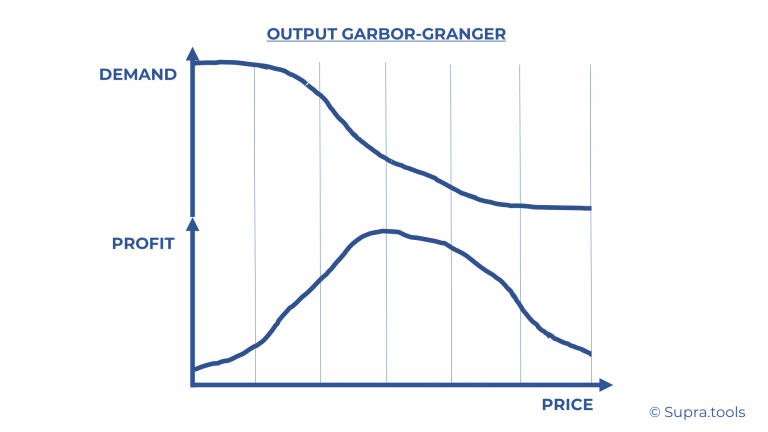

Scale points 1-6 are usually rated afterward by a purchase probability percentage. Multiplying this by the price gives the expected value of sales. If you subtract the retail margin, the sales tax (at least in Europe), and the manufacturing costs from this turnover, you get the profit.

Some professionals prefer to access video tutorials around pricing and insights

The Gabor Granger Pricing technique thus enables profit optimization and optimal price

Limitations and further developments of the Gabor-Granger method: Simple, cheap, and precise methods.

Gabor-Granger is the simplest method to enable meaningful profit-maximizing price optimization. The Van Westendorp method makes it possible to explore the range of possible prices in a completely unbiased way.

Both methods are subject to strong survey biases in some cases. Depending on the context, respondents have a fundamental tendency to underestimate their willingness to pay. The extent of the bias varies greatly in individual cases so it cannot be anticipated across the board.

The quality of the survey also depends on the realism of the product description. Products whose willingness to pay is largely determined by the price of the comparison product (shelf neighbor) should be presented in exactly the same way: a shelf example with an anchor price of the shelf neighbor. For this case, the methods measure a price-premium willingness rather than the price-sales function.

Further development of the Gabor Granger Pricing method: Indirect methods

To avoid the response bias regarding the underestimation of the willingness to pay, so-called indirect methods have been developed

The first two groups of methods do not fulfill the characteristics listed above. They are not easy to set up and not easy to interpret, nor are they inexpensive.

Implicit IntelligenceTM methods are an exception. They combine neuroscience measurement methods and calibrate their results with causal machine learning. The methodology is elaborate, but for the user, it is as simple as the Gabor-Granger method and the costs are also moderate.

The methodology has been tested and perfected by Supra.tools since 2016. They are a valuable addition to the spectrum of methods for price optimization.

Learn more about Implicit Intelligence here.

Today pioneers use the latest pricing survey tools that use Neuroscience + AI

Interested professionals can use some tools even for free and explore on its own

You can access supra tools free here.

When is Gabor Granger Pricing Method Ideal to Use?

Gabor Granger’s pricing technique is instrumental in pricing studies that fit the below criteria:

What are the Prerequisites For Gabor Granger Pricing Research?

The Gabor Granger Pricing Technique requires a few conditions before it can be used successfully:

There needs to be an established price range that needs to be optimized

This technique requires historical data such as a previously identified range of prices or a predetermined price list to begin. You require upper and lower anchors for predefined prices to form the basis of your survey research. These can then be used to pinpoint the optimal price point.

All the other components related to the product/service cannot be changed

Retailers have other strategies to drive sales, such as changing other variables like benefits, discounts, or promotions. However, when these attributes are fixed, the Gabor-Granger can be used to manipulate the marketing mix. It is effective in bolstering sales when other components are stagnant.

The brand or SKU under market research is considered without looking at the competition.

The Gabor-Granger technique requires you to forgo competing products. It is based on your business demand curve rather than the whole industry. So you have to check price elastic without looking at the competition.

What are the End-results of the Gabor Granger Model?

Gabor Granger can bring several results such as:

Finding optimal price predicting sales, price elasticity, revenue, and demand curve for your business

In other words, the answers gleaned from Gabor-Granger will help in optimal pricing and provide you with enough data to predict price curves, revenue curves, and profit at different prices.

The different price points where the demand starts to decline

Not only is this model used for price optimization and price elasticity, but it can also highlight areas of caution. These are the higher price point affecting sales. In addition, the data collected will highlight when a higher price will affect demand negatively.

The price which results in the revenue-optimizing price points

The market research of Gabor Granger also helps determine price points to maximize revenue. Consumer research can act as the basis for finding the one price at which your revenue is maximized. Remember, this is not always the maximum price but a pricing strategy that generates maximum revenue.

Which is Better: Gabor Granger or Van Westendorp?

The most common debate in the world of price elasticity is whether to use the Gabor Granger pricing model or the Van Westendorp technique. Both of them are the most common direct methods used to determine product price points. Generally, the Gabor Granger pricing model is ideal for established products, while the Van Westendorp technique is optimal for the new product offerings.

Moreover, the Gabor Granger model is for the prediction of the demand curve and finding the optimal pricing. On the other hand, Van Westendorp price sensitivity helps get a range of acceptable prices and predict a price sensitivity meter.

Each model is different and has unique needs. Thus they are used in varying cases. Below are more realistic scenarios where each pricing method is appropriate.

Gabor Granger Model Scenarios

Van Westendorp Technique Scenarios

In my email newsletter “Pricing Insights” I cover the whole range of pricing insights solutions-from Garbor Granger to Conjoint, from NeuroPricing to Pricing Software Systems. I describe the application in various fields from new product pricing to promotion, from brand premium to feature pricing.

Keep up to date here.