February 7, 2023

B2B Pricing Model for SaaS Pricing: How to Find the Best Price Point

Everyone knows this. Everything seems as clear as day and logical. But then – the customer sees it quite differently.

The problem in B2B SaaS is this. The target group is comparatively small and it is usually neither easy nor cheap to initiate a survey.

Also, trying out prices is not without risk. Theoretically, it is an option to simply test a new price over a certain period of time. Maybe even as an A/B test. But in doing so, you can quickly scare away customers and damage your reputation.

In B2B, trust matters more than anywhere else. Transparency, honesty, and consistency are virtues that nurture this, and they can destroy it with price testing.

If you then get around to conducting a customer survey, things quickly get complicated when it comes to pricing strategy. This is because the respondents have a vested interest in keeping their willingness to pay under wraps. What’s more, the real ultimate willingness to pay is often not even consciously stored, but subconsciously.

Many SaaS pricing experts generally focus on other topics. Topics that are less technical and methodological but strategic in nature. Here are some of these topics. They are all important or useful, but they do not solve the fundamental issue of transparency about willingness to pay.

“Foot in the door” methods

Offer low-cost entry-level product packages, to the extent that your product is so good that customers will want to upgrade afterward. If the upgrade strategy succeeds, it may make sense to subsidize the entry-level product. “Free” versions are the purest form of this strategy.

“Price anchor” method

Often product packages are created just to serve as a price anchor. An expensive package makes the middle option seem cheap. People tend to gravitate towards the middle product, so the premium product itself is not there to be bought, but only to increase the willingness to pay for the middle one.

Setup Fee

In B2B SaaS, integration of the software or processes is usually required. Many companies have started to charge new customers a setup fee. At first it seems counterproductive to build up a barrier to entry. However, these setup costs are mostly irrelevant for B2B buyers. What is relevant is that the software actually provides benefits and for that companies need hands-on help. The setup fee communicates to the customer that they are then entitled to have the SaaS company “make the product work”. It also creates “sunk costs” and thus a psychological barrier to exit. Last but not least, the setup fee provides an early liquidity booster that enables higher customer acquisition costs as the new customers provide the liquidity.

Psychology of pricing

There are separate books on the topic of pricing psychology. Often the techniques are marginal or very context specific. Nevertheless, it is worth knowing the classics:

Pricing Models Smoke candles

All these and many more exciting approaches exist. But too often they are used to complicate the issue. Because one thing is unclear: to what extent they are useful.

Therefore, it is recommended to start with a successful standard framework and to focus on the topic that has the greatest impact. We now present this framework.

A telecommunications giant was new to this SaaS space. Suddenly, the innovation team came up with a potential multi-billion dollar product. It became abundantly clear that appropriate pricing was essential.

The first step was to choose a bundle structure. The team decided against the typical three-product structure because there was enough complexity in terms of country- and media-specific pricing requirements.

Therefore, in this case, it was not necessary to develop a strategy that assigns features to bundles.

Rather, the central question was how to position oneself in the competitive environment. For every price point, there was a proponent within the company. Not an easy task. Complicating matters further was the fact that the product had already had a soft launch.

The product team was proud of the fact that there was no negative customer feedback regarding the price. As it turned out, this was an indicator that the price was too low.

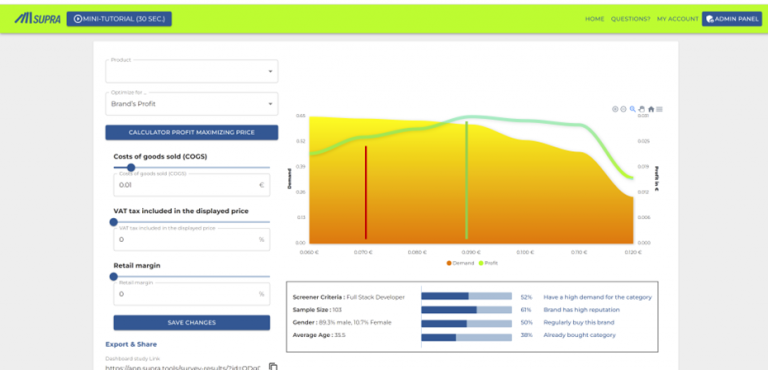

To determine the optimal price, the Implicit Pricing Intelligence method was used, interviewing 100 highly specialized professionals who represent the key people in the buying center.

The results were eye-opening. It turned out that the current price per unit was in an “inelastic range”. A 28.5% increase in price hardly leads to a decrease in demand and significantly increases profit.

Another 21% increase is in an “indifference zone”. Demand falls here – but to roughly the same extent as the margin increases. If it is possible to highlight the added value of one’s own product better than in the current product description, a price increase of about 50% can also become optimal in perspective.

At price points above 50%, demand falls too sharply.

The company decided to set the price point at +28% and thus the maximum demand at 30% higher possible revenue.

STEP 1: Structure your offering

There are three classic best practice structures: the one-product offering, the 3-package offering, and segment-specific “gated” pricing.

The 3-package offer gives an entry-level offer that can be used to attract prospects as customers to “upgrade” them later.

If developing customers in your case is difficult or hardly crowned with success, the entry package is also used as a price anchor. The price is then set close to the middle price and the included services and features are greatly reduced.

The middle offer is to become the most sold and the premium offer is used as an upper price anchor.

In the case study above, the one-product structure was chosen. Its advantage lies in its simplicity. Simplicity alone increases the willingness to buy. “Confused minds dont buy”

However, you can often observe price pages that contain four, five or more packages. Here they try to serve different customer segments (small customers, medium customers, large customers). The disadvantage is a high complexity. Especially when the enterprise model says “price on demand”.

Segment-specific “gated” pricing is a better alternative. Here, there is no public price overview. Instead, the system first determines which customer segment a customer belongs to and then sends them an “individual” price quote – usually automatically.

STEP 2: Bundle the right features

Product bundles differ in the features that are enabled and the scope of services, such as the number of users or certain service credits.

The question is which features should be included in which package. For this question, the first thing to clarify is what the goal of each package is. The typical goal structure is to have an entry-level package that is just good enough to make it attractive. However, once one has acquired a taste, this package should no longer be sufficient.

The premium package can be loaded with additional services that are not essential, because this package usually has only the anchor price function.

Proposals can be developed according to this logic. Behind the estimation are assumptions about how useful each feature is to the target audience and what willingness to pay it evokes.

Quantitative feature set optimization can be performed using conjoint and MaxDiff analyses. If the variety of such features available for distribution among different packages is limited, then this optimization can also be done in the following step 3 with.

STEP 3: Optimize prices with Implicit Pricing Intelligence.

The final step is to optimize the final price. The conjoint analysis mentioned above is one way. It can also be used to simulate the choice situation with all three packages.

However, conjoint analysis has some disadvantages. Setting it up requires a certain amount of expertise. In addition, several hundred respondents are often necessary, which seems to be either expensive or even impossible in B2B.

An alternative is Implicit Pricing Intelligence. It already works stable with only 50 respondents and can be set up and started within 5 minutes. The interpretation of the results is simple, clear and unambiguous. In addition, costs are only in the triple digits – something any B2B SaaS startup can afford.

The survey invitation is either sent to your own prospect list or to a B2B panel.

The method is presented in detail in our article “Implicit Intelligence”. This article here also presents a study by Ostfalia University, which shows that the method is also better suited than conjoint to measure willingness to pay validly.

Today pioneers use the latest pricing survey tools that use Neuroscience + AI

Interested professionals can use some tools even for free and explore on its own

You can access supra tools free here.

Pricing is the fastest and biggest lever of profitability. Used incorrectly, it causes flops and profitability problems.

The most common mistake, even in B2B SaaS, is that too little attention is paid to the customer’s point of view. Unfortunately, this is still the case because it has not been easy or inexpensive to perform valid willingness-to-pay measurements.

Knowing and applying pricing strategies is important and homework that every B2B SaaS company should do. However, its importance is overestimated because it is relatively easy to philosophize about strategies and form opinions.

The practical optimization of B2B SaaS pricing is done in three steps: 1. The choice of pricing model. 2. the feature assignment to the packages and 3. the actual price optimization.

The Implicit Pricing Intelligence method enables even startups to precisely adjust their prices by asking only 50 target customers, so that growth and profitability are no longer opposites.

In my email newsletter “Pricing Insights” I cover the whole range of pricing insights solutions-from Garbor Granger to Conjoint, from NeuroPricing to Pricing Software Systems. I describe the application in various fields from new product pricing to promotion, from brand premium to feature pricing.

Keep up to date here.